34+ kentucky paycheck calculator 2022

Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week. All you have to do is enter each employees wage and W-4 information and our calculator will process their gross pay deductions and net.

Anesthesiologist Archives The Anesthesia Consultant

Web Kentucky Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and.

. Discover ADP Payroll Benefits Insurance Time Talent HR More. Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator. Are You Withholding Too Much in Taxes Each Paycheck.

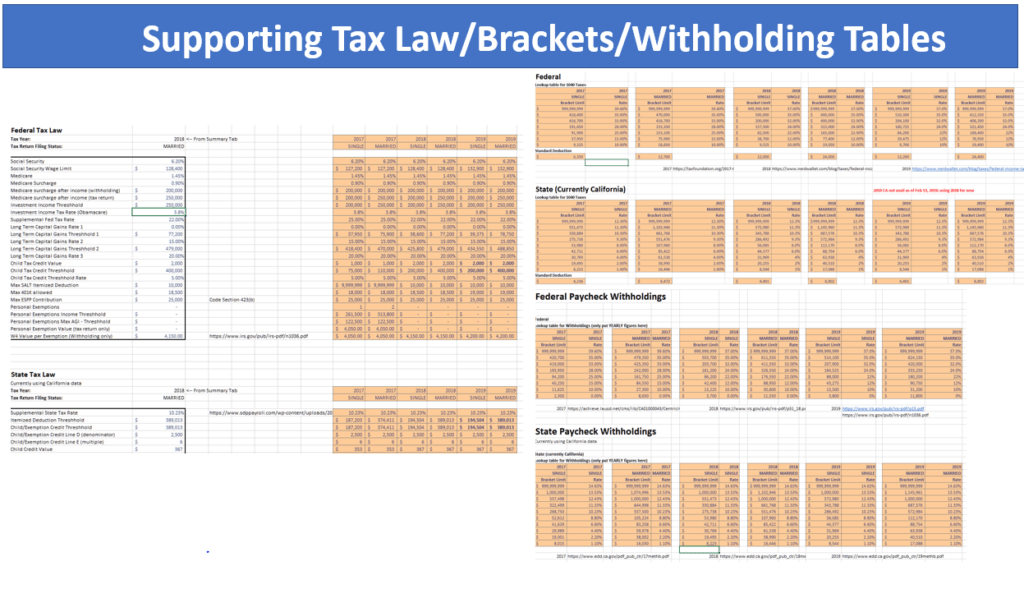

Web The Kentucky Tax Estimator Will Let You Calculate Your State Taxes For the Tax Year. Net income Adjustments Adjusted gross income Step 3. The Federal or IRS Taxes Are Listed.

Web Free Paycheck Calculator. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Get Started With ADP Payroll. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Dont Just Hand It Over Only to Get It Back With Your Return. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. 2022 all companies must file and.

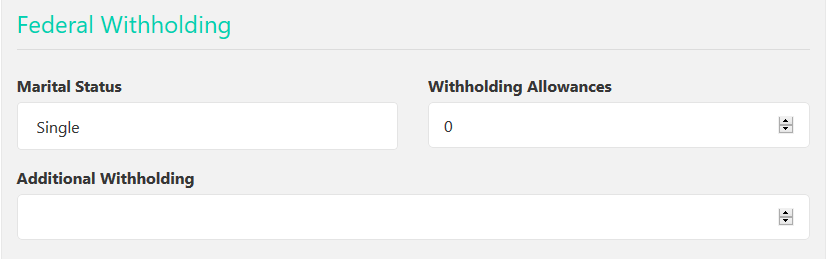

Paycheck Based W-4 Form. Web The process is simple. Afraid You Might Owe Taxes Later.

Web How do I use the Kentucky paycheck calculator. Web The following steps allow you to calculate your salary after tax in Kentucky after deducting Medicare Social Security Federal Income Tax and Kentucky State Income tax. Web Kentucky tax year starts from July 01 the year before to June 30 the current year.

Web The Kentucky Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year. Ad Compare 5 Best Payroll Services Find the Best Rates. Ad Keep More Of Your Money Now.

Ad Process Payroll Faster Easier With ADP Payroll. Determine your filing status Step 2. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider.

The Federal or IRS Taxes Are Listed. Web Salary Paycheck Calculator Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried. The Kentucky minimum wage is 725 per hour.

Make Your Payroll Effortless and Focus on What really Matters. Web Select Pay Frequency Enter Taxable Wages Per Pay Period Employee Name Optional. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Web Kentucky Income Tax Calculator 2022-2023 If you make 70000 a year living in Kentucky you will be taxed 11493. Your average tax rate is 1167 and your marginal. Web How do I figure out how much my paycheck will be.

Simply follow the pre-filled calculator for Kentucky and identify your withholdings allowances and filing status. And the calculator will generate the amount of withholding tax for the pay period. Tools Tax Calculators Tools.

Kentucky Salary Calculator 2023 Icalculator

5510 Flint Ridge Church Rd Marshville Nc 28103 Realtor Com

Kentucky Paycheck Calculator Tax Year 2023

Free Kentucky Payroll Calculator 2023 Ky Tax Rates Onpay

Pdn20130308j2 By Peninsula Daily News Sequim Gazette Issuu

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Babson College The Princeton Review College Rankings Reviews

Bling Crystal Belt Correctconnect

February 2021 Hereford World By American Hereford Association And Hereford World Issuu

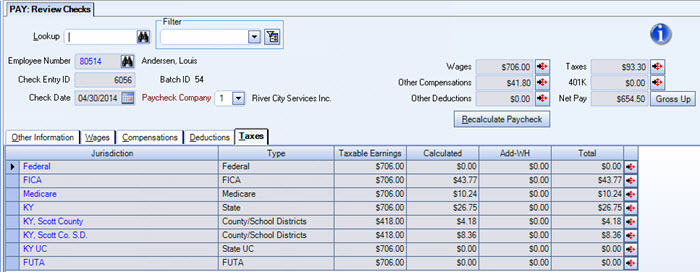

Kentucky County School District Taxes

How A Speeding Ticket Impacts Your Insurance In North Carolina Bankrate

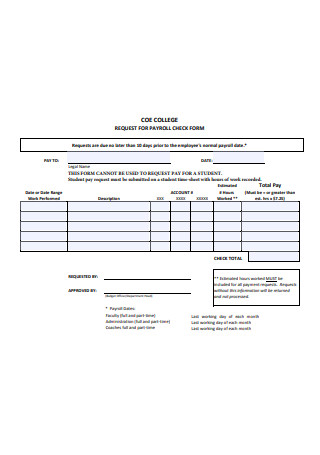

34 Sample Payroll Checks In Pdf Ms Word Excel

.png?width=850&mode=pad&bgcolor=333333&quality=80)

The Villages Of Burlington Apartments 5109 Frederick Lane Burlington Ky Rentcafe

Kentucky Income Tax Calculator Smartasset

Upton Oxmoor Apartments 7725 Oxmoor Lane Louisville Ky Rentcafe

Paycheck Calculator Kentucky Ky 2023 Hourly Salary

February 2022 Dc Beacon By The Beacon Newspapers Issuu